Compare Flood Insurance Coverage from Top Providers

Protect your home or business from sudden flood damage. Get quick quotes from more than 20 insurers, including NFIP and private flood companies.

Why Choose Insurox? Compare flood insurance quotes instantly, access coverage in all 50 states, and buy online with support from licensed experts.

Why Flood Insurance Matters

Floods are the most common and costly natural disasters in the United States. They impact homeowners and businesses in every state. Despite this, most property insurance policies do not cover flood damage. That’s why it’s critical to understand what flood insurance covers and how it helps cover flood-related losses.

Flooding can happen anywhere, whether you live in a high-risk flood zone or a safe area. According to FEMA, over 20% of flood claims come from properties outside designated flood zones. The right flood insurance coverage can make all the difference when disaster strikes.

️What Does Flood Insurance Cover?

Flood insurance typically provides two types of coverage: building coverage and contents coverage. Here’s what each type typically covers:

- Building Coverage: This covers damage to your home or business structure. It includes walls, floors, and the foundation. It also covers electrical systems, plumbing, heating, and central air systems. The design includes built-in appliances, like water heaters.

- Contents Coverage: Covers personal belongings or business inventory such as furniture, electronics, clothing, and portable appliances. Be aware that some items in basements may have limited coverage.

Certain policies provide extra advantages, including expenses for clean-up, debris clearance, and preventive actions like sandbagging. Private flood insurance typically covers damages more thoroughly than NFIP policies and might also offer replacement cost coverage.

You must understand what flood insurance covers to ensure you adequately protect yourself. Insurox helps you find different flood insurance options. These options depend on your property’s location, risk level, and type of structure.

No Elevation Cerificate. No Photos.

Instant Flood Insurance Comparison

➡️ We’ll show you both side-by-side so you can choose the best one for you.

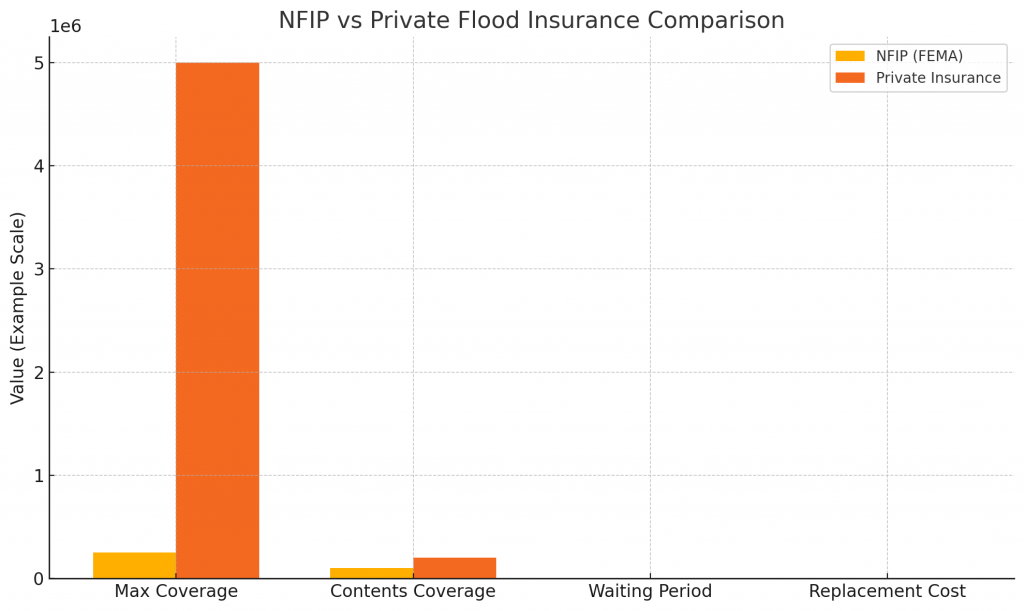

You can bundle or customize it to fit your needs. Waiting Period 30 days 0–10 days Replacement Cost Coverage Rarely included Often included

Private policies typically offer shorter waiting periods, higher limits, and broader flood insurance coverage. At Insurox, we show you both options side-by-side, so you can make the best decision for your property.

NFIP policies are standardized and federally backed, making them reliable but often limited. Private policies provide flexibility in pricing, structure, and endorsements, giving you enhanced control over what your flood insurance covers.

Who Needs Flood Insurance?

Anyone who owns or rents a home or business property should consider flood insurance coverage. Here’s why:

- High-risk flood zones: Properties in FEMA-designated flood zones are often required by lenders to carry flood insurance.

- Moderate-to-low risk areas: Flooding still occurs in these areas. In fact, they account for more than 20% of NFIP claims.

- Coastal and inland areas: Storm surges, hurricanes, and rapid snowmelt can affect both coastal and inland locations.

If you’re unsure whether you need flood insurance, consider this: if it can rain, it can flood. Don’t delay until it’s too late to insure against flood damages that might cost thousands.

Businesses that store valuable equipment or inventory, or rely on digital infrastructure, are especially vulnerable to flood damage. Even a few inches of water can result in major financial losses without the right coverage.

Flood Insurance for Homeowners and Businesses

Insurox provides comprehensive flood coverage for a wide variety of property types:

- Single-family homes and multi-family residences

- Commercial buildings and offices

- Rental properties and vacation homes

- Retail stores and warehouses

We help you compare policies from the NFIP and private carriers to find a plan that meets your unique needs. Whether you need insurance for your home, your business, or both, we have you protected.

Homeowners benefit from flood insurance that covers damages to essential systems, including water heaters, HVAC units, and electrical panels. Business owners experience greater peace of mind. They know that custom policies can cover their inventory, equipment, and temporary relocation costs.

Insurox Serves All 50 States

From California to Florida, from Texas to New York—Insurox helps you compare and save on flood insurance anywhere in the U.S.

Looking for state-specific info?

View flood insurance in your state »

How to Get a Flood Insurance Quote?

Getting started with Insurox is fast and easy:

- Enter your ZIP code and property details

- Compare real-time quotes from top-rated carriers

- Buy online or speak with a licensed agent

No elevation certificates. No images. Just quick and accurate quotes.. Avoid delays by securing your flood insurance today—before the next storm arrives.

Real Stories: How Flood Insurance Helped Our Customers

“When Hurricane Ida hit our neighborhood, our basement flooded within hours. Thanks to our policy through Insurox, we received a payout within 10 days that covered cleanup and repairs.” – Janet R., New Jersey

“We operate a small business in Houston and had no idea we were at flood risk. “After a strange storm, we lost thousands in inventory. But the private flood policy we found on Insurox saved our business.” – Carlos M., Texas

These true stories show how careful planning and good flood insurance can help when disaster hits.

Cost Factors That Influence Flood Insurance Premiums

Flood insurance premiums are determined by multiple variables. Understanding these can help you make informed decisions about your coverage. Some of the major cost factors include:

- Location and Flood Zone: Properties in high-risk flood zones (like Zone AE or VE) usually have higher premiums.

- Elevation: Elevating your home or business above the base flood level can help you qualify for lower rates.

- Type of Coverage: Opting for replacement cost coverage versus actual cash value affects premiums.

- Deductibles: Choosing a higher deductible may lower your premium.

- Building Characteristics: Foundation type, number of floors, and building materials can also influence your rate.

At Insurox, we help customers look at these factors. We customize their flood insurance coverage for the best protection and price.

Bundling and Policy Discounts

One way to make flood insurance more affordable is to bundle it with other policies. Insurox offers multi-policy discounts when you combine flood insurance with:

- Homeowners Insurance

- Renters or Condo Insurance

- Commercial Property or Business Insurance

In addition to bundling, you may also qualify for discounts based on:

- Installing flood mitigation systems such as sump pumps or flood vents

- Having a documented elevation certificate

- Being part of a participating NFIP Community Rating System (CRS) program

Ask us how to save more on your flood insurance coverage while maintaining strong protection.

Preparing for Flood Season: Prevention and Planning Tips

Flood preparation is an essential part of responsible property ownership. Here are several best practices to protect your home or business:

- Know Your Flood Zone: Use FEMA’s Flood Map Service Center to determine your property’s risk level.

- Review Your Policy: Understand what your flood insurance covers—don’t wait until disaster strikes.

- Document Valuables: Take photos of key belongings and store records in a waterproof or digital format.

- Elevate Equipment: Raise water heaters, electrical panels, and HVAC units above base flood elevation if possible.

- Create an Emergency Plan: Leave the area safely, emergency contacts, and shelter locations.

Being proactive before flood season starts can reduce risk and ensure that your claims process goes smoothly.

What Happens If You Don’t Have Flood Insurance?

Many property owners mistakenly believe they are safe from flooding or that federal disaster aid will cover any losses. However, this is not always the case.

- FEMA often provides disaster aid as a loan, not a grant—so you must repay it with interest.

- Most property insurance policies explicitly exclude flood damage.

- Just one inch of floodwater can cause up to $25,000 in damages.

Without flood insurance, you must pay for cleanup, repairs, and replacements out of your own pocket. Don’t take that risk—let Insurox help you find a policy that covers flood damage and gives you peace of mind.

What Happens If Your Flood Insurance Lapses?

Lenders typically require you to carry flood insurance if your property is in an AE flood zone and has a mortgage. In many cases, the National Flood Insurance Program (NFIP) offers the most affordable option for this type of property.

If your flood policy lapses because neither you nor your mortgage company paid the renewal, things get complicated. Once coverage has been inactive for over 30 days, the NFIP does not allow reinstatement. You must purchase a new policy, and a mandatory 30-day waiting period applies before the coverage begins.

Because this isn’t a new loan closing, there is no exception to the waiting period. At this point, you have two main options:

- Buy private flood insurance: It may start right away or after a 7–15 day wait, but it usually costs more than NFIP.

- Start a new NFIP policy: You can pay the same premium as before, but the 30-day waiting period will apply. During this time, your mortgage company may purchase a force-placed flood policy, which can add extra costs to your escrow account.

At Insurox, we help you understand your options and find affordable flood insurance to protect your property without overpaying.

Expert Assistance

As one of the country's leading Flood insurance agency, our highly trained claim professionals are knowledgeable about flood insurance losses and able to provide you with superior claim service.

How Private Flood Insurance Companies Calculate Your Premium – Understanding Replacement Cost and Coverage

When shopping for flood insurance, you might wonder how your premium is actually calculated. It’s not just about your coverage amount — there’s a more complex formula at work.

This is how they calculate your premium:

Private flood insurance companies use your property’s Replacement Cost Value (RCV) in conjunction with something called the “Insured to Value” (ITV) factor or “First Loss Factor” (FLF). These rating methods determine whether you’ll receive discounts (credits) or surcharges (debits) on your policy.

Let’s break it down.

What Is “Insured to Value” and Why Does It Matter?

Insured to Value (ITV) is a ratio that compares the amount of coverage you’re purchasing to your property’s full replacement cost.

-

A higher ITV ratio (closer to full replacement cost) usually results in more credits, which leads to a lower premium.

-

A lower ITV ratio (insuring far below replacement cost) leads to more debits, which increases the premium per $1,000 of coverage.

The First Loss Factor (FLF) is essentially the flip side — it applies surcharges based on how far underinsured a property is.

Real-World Flood Insurance Premium Comparison

Let’s look at two properties requesting the same amount of coverage — but with different replacement cost values.

🏠 Example A:

-

Coverage Requested: $250,000

-

Replacement Cost Value (RCV): $500,000

-

ITV Ratio: 50%

-

Breakdown:

-

50% insured to value = limited credits

-

50% first loss factor = more debits

-

-

Estimated Premium: $1,875

🏠 Example B:

-

Coverage Requested: $250,000

-

Replacement Cost Value (RCV): $300,000

-

ITV Ratio: 83%

-

Breakdown:

-

83% insured to value = significant credits

-

17% first loss factor = minimal debits

-

-

Estimated Premium: $1,463

👉 Same coverage, but nearly a $400 difference in premium — all due to the insured-to-value ratio.

Common Misconception: “If I Insure for Less, I’ll Pay Less”

Not always.

Many assume that choosing lower coverage automatically lowers their premium. But with private flood insurance, underinsuring your property often leads to a higher rate per $1,000 of coverage. The more accurately you insure your property to its true value, the more favorable your premium will likely be.

How to Get the Most Accurate Quote

To ensure you’re not overpaying for your flood insurance, make sure you:

✅ Provide accurate property details (square footage, construction, year built, etc.)

✅ Allow us to calculate your replacement cost using industry tools

✅ Avoid lowballing your coverage just to save upfront — it could cost more in the long run

Bottom Line: Replacement Cost Affects Your Rate

Private flood insurance is often more flexible and competitively priced than government-backed options — but only when coverage and replacement cost align.

Insuring closer to your property’s true value can earn you rate credits and save you money. Underinsuring? That can actually cost you more.

People also ask

Yes. You can get flood insurance if you live in a floodplain or high flood-risk area.

-

You can get flood insurance if you live outside a floodplain, or in a low to moderate flood-risk area, and at lower cost.

-

You can get flood insurance if your property has been flooded before.

-

You can get flood insurance from insurance agents in your area.

-

You can buy flood insurance even if your mortgage lender doesn’t require it.